- Home

- >

- Simple Interest – Explanation & Examples

Simple Interest – Explanation & Examples

Have you ever lent or borrowed money from your friend or relative? What happened when you returned the money? Did you return same amount you borrowed? Well, that extra amount you pay when settling a debt or loan is what is referred to as interest and this concept is called simple interest.

Have you ever lent or borrowed money from your friend or relative? What happened when you returned the money? Did you return same amount you borrowed? Well, that extra amount you pay when settling a debt or loan is what is referred to as interest and this concept is called simple interest.

The official discovery of interest was found in 16th century by Jacob Bernoulli. He introduced a constant ‘e’ for the interest. He gave a formula limit n approaches infinity (1 + 1/n) ^ n = e, where n represents the number of times the interest is compounded in a year.

Simple interest is an application of percentage. Understanding the concept of simple interest is not only important for you to know how to solve problems in class, but also is a fundamental skill to help you manage your finances. With the basic knowledge on how the concepts work, you get empowered to make good financial decisions. In this article, we are going to learn how to calculate simple interest and the knowledge to solve real life problems. Let’s first start by defining the terms involved in simple interest.

The principal amount (P)

The principal is the money borrowed or initial amount of money deposited in a bank. The principal is denoted by a capital letter “P.”

Interest (R)

The extra amount you earn after depositing or the extra amount you pay when settling a loan. Interest is normally represented by a letter “R” because it is calculated as a rate or percentage.

Time(T)

This is the period at which money is borrowed or deposited. Time is normally expressed in months or years. It is denoted by a capital letter “T.”

Amount(A)

The amount is the sum of the total interest and the principal over a given period.

What is Simple Interest?

Simple interest is the amount paid on a principal amount of money that is borrowed or loaned to someone. Similarly, you can as well earn an interest when you make a deposit of certain amount in a bank. Simple interest concept is majorly applied in various sectors including banking, mortgages, automobile, and other financial institutions.

How to Find Simple Interest?

Simple interest is simply calculated finding the product of the principal amount borrowed or lent, the rate of interest and the term or repayment period of the loan.

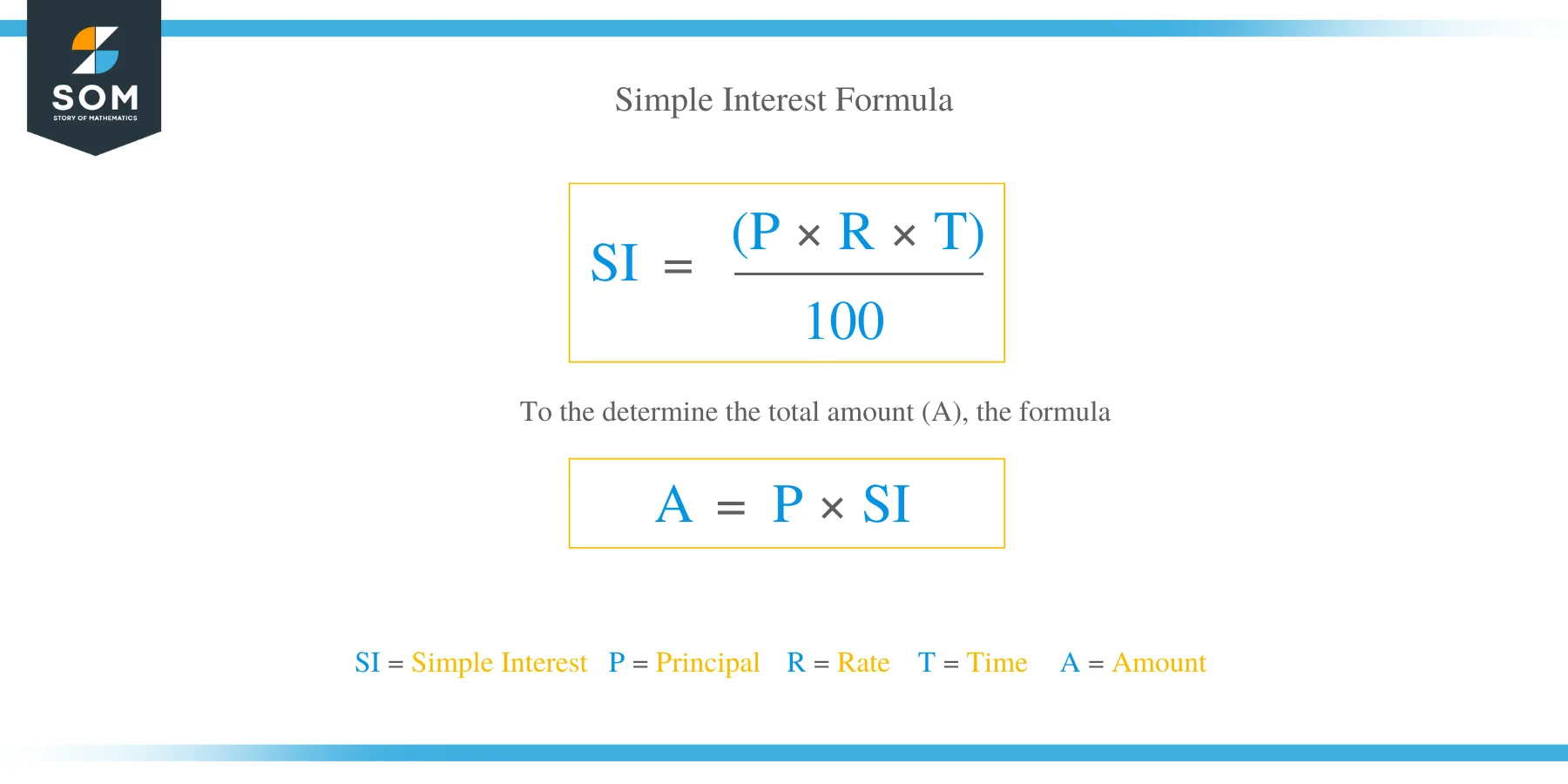

The formula for Simple interest is given by:

SI = (P × R × T) / 100

Where;

SI = simple interest

P = principal

R = interest rate (expressed percentage)

T = time duration (in months or years)

The Formula for simple interest is used to calculate the interest amount if time and the principal amount are known.

In order the determine the total amount (A), the formula below is applied:

Amount (A) = Principal (P) + Interest (I)

Where;

The amount(A) is the total money paid back at the end loan repayment period for which it was borrowed.

Example 1

A woman deposited $ 50000 in a bank which charged an interest of 5 per cent p.a. Calculate the interest and the amount she earned after 2 years.

Explanation

Take; The principal (P) = $ 50000,

Time (T) = 2 years,

Rate (R) = 5 % p.a.

Substitute in the values in the simple interest formula;

(SI) = [(P) × (R) × (T)]/100

= (50000 x 5 x 2)/100

= $ 5000

Therefore, she earned an interest of $5000

The amount (A) = Principal (P) + Interest (I)

Substitute;

= 50000+ 5000

= $ 55000

Hence, the woman got $ 55000

Example 2

Tyson invested a certain amount of money in a bank. The bank paid him $9000 after a given period of time. If the interest paid by the bank was $1200, calculate the amount of money Tyson invested?

Explanation

The amount (A) = $ 9000,

Simple Interest (SI) = $ 1200

From the formula;

Principal (P) = Amount (A) – Interest (I)

= 9000 – 1200

= $7800

Therefore, Tyson invested $ 7800.

Example 3

Maria deposited in a bank $6400 and earned $ 8000 after a year. Calculate the simple interest she earned?

Explanation

The principal (P) = $ 6400,

Amount (A) = $ 8000

Apply the formula;

Simple Interest (SI) = Amount (A) – Principal (P)

= 8000- 6400

= $1600

Therefore, Maria earned an interest of $ 1600

Simple interest has many applications, like bonds and mortgages. Bonds pay coupon payment in the form of non-compounding interest. Similarly, non-compounding interest mortgages often used with a bi-weekly payment plan to pay the loan sooner.