JUMP TO TOPIC

Gross|Definition & Meaning

Definition

Gross refers to some amount (often of money) before applying any deductions. The gross profit of a shop, for example, is the revenue earned from the sale of products without subtracting the cost of those sold goods (business expenses like manufacturing, supply, etc.). The amount left over after deductions is called the net (net profit in this case).

Figure 1 – Gross

Concepts of Gross

In mathematics, the term “gross” indicates the total or full amount of a quantity before any deductions or adjustments are made. It is often used in accounting and finance to describe revenues, profits, and other financial metrics. For example, gross income is the total amount of money earned before subtracting expenses or taxes.

Gross profit is the simplest form of profit: revenue minus cost. Alternatively, it is the difference between the revenue and the cost of goods sold (COGS). To get the gross margin, we additionally divide this difference by the revenue and multiply it by 100 to get the gross margin as a percentage.

In some cases, “gross” can also be used to indicate the product of a number and 12. For example, “12 dozen” equals “12 gross” or 12*12.

Gross typically refers to the full or total amount of a quantity before any deductions or adjustments are made.

What Does Gross Mean?

“Gross” typically refers to the full amount of a quantity before any deductions or adjustments are made. This can include the gross domestic product (GDP), the total amount of all services and goods produced within a country in each period. GDP is measured by the economic activity of a country and is often used as an indicator of the overall health of an economy.

Another important economic measure that uses the term “gross” is gross national product (GNP), which is like GDP but also includes income earned by people of that country despite where they live in that country. This is a more comprehensive measure of a country’s economic activity, as it considers both domestic production and income earned abroad by citizens.

In addition, gross investment is the total amount of capital invested in an economy, including both private and government investment. It is a measure of the economy’s capacity to grow and expand.

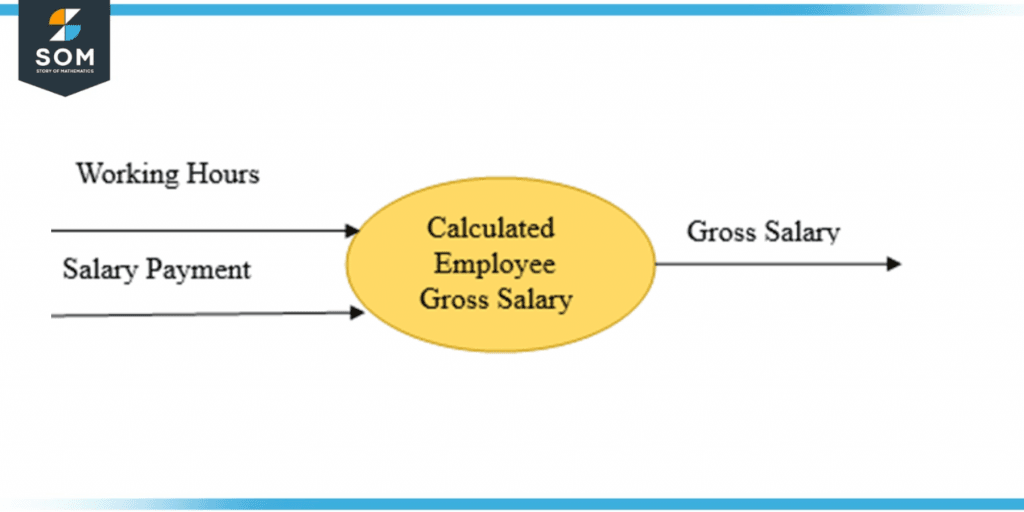

Figure 2 – Gross Pay

Gross domestic income (GDI) is measured by the total income generated by the services and goods produced by a country. It measures the value added to the economy by producing goods and services.

Another use of “gross” in economics is gross margin, which is the difference between revenue and the sale price of goods as the percentage of revenue. It measures the profitability of a company or industry.

In accounting, “gross profit” is the difference between revenue and cost of goods sold. It measures how much profit a company makes from its sales before deducting expenses such as overhead costs, taxes, and interest.

The term “gross,“ as opposed to “net,” indicates the total or full amount of a quantity before any deductions or adjustments are made. This can include measures of economic activity such as GDP and GNP, as well as measures of profitability and investment. These figures are important indicators of the overall health and growth of an economy and are closely watched by economists and policymakers.

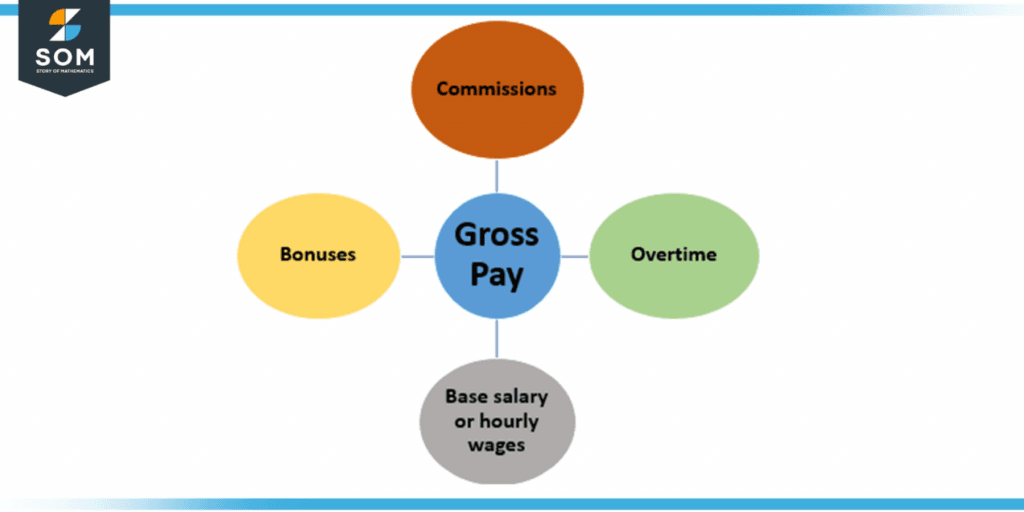

Figure 3 – Gross Domestic Products

In the above figure, Gross Domestic Product (GDP) is measured by any country’s economic progress and is often used to indicate the overall health of an economy. It is the total value of all services and goods produced in a country at a given time.

In mathematics, “gross profit” is the difference between revenue and cost of goods sold. It measures how much profit a company makes from its sales before deducting expenses such as overhead costs, taxes, and interest. Net profit, though, is the total amount of profit any company makes after subtracting all expenses from revenue.

One of the most common examples of the difference between gross and net is with respect to income. Gross income is the sum of the amount of earned money any company earns before any deductions. On the other side, net income refers to the amount of money earned after all deductions and expenses have been subtracted.

These deductions include taxes, overhead costs, and other expenses that are necessary to run a business or maintain a household.

Figure 4 – Gross Income is part of the net income equation.

Here in the above figure, the gross income refers to the total money earned without any deductions, whereas the net income refers to the amount of money earned after all deductions.

Quick Summary and Formulae

Income

Gross income, again, shows the raw earnings without any deductions for any expenses. Net income, like net profit, refers to the amount of money earned after all deductions and expenses have been subtracted.

Gross Income = Total Sales – Cost of Goods Sold

Net Income = Gross Income – All Deductions (e.g., taxes and other costs)

National Income

Gross Domestic Product (GDP) refers to the country’s economic growth and is often used as an indicator of the overall health of an economy. Gross National Product (GNP) includes the income earned by citizens of a country regardless of where they are located, and it considers both domestic production and income earned abroad by citizens.

GDP = Private Consumption + Government Spending + Gross Private Investment + Government Investment (Exports – Imports)

GNP = GDP + NIA

Where NIA is net income from abroad:

NIA = money flowing in from foreign countries + money flowing out to foreign countries

Investment

Gross investment is basically the total amount of capital invested in an economy, including both private and government investment. Net investment, on the other hand, is the total amount of capital invested in an economy after deducting depreciation.

Gross Investment = Net Working Capital + Fixed Assets + Accumulated Depreciation + Accumulated Amortization

Net Investment = Gross Investment – Capital Depreciation

Profit

Gross profit is the difference between the sale price and revenue. It measures how much profit a company makes from its sales before deducting expenses such as overhead costs, taxes, and interest. Net profit, on the other hand, is the profit that a company earns after all expenses have been subtracted from revenue.

Gross Profit = (Gross Profit / Revenue) * 100

Net Profit = Gross Profit – All Deductions and Other Expenses

Examples of Gross in Finance

Example 1

Solution

If a school has 50 teachers, and each teacher earns a salary of \$2,000, the gross salary of all teachers is 50 * \$2,000 = \$10,000. In this case, “gross” refers to the total salary amount before any deductions for taxes or benefits.

Example 2

Solution

Example 3

Solution

Let’s say you sold 60 units of a product for \$5 each. The total revenue generated would be \$300, which is the gross amount, before considering the costs of production or any other expenses that may decrease the net profit.

All the figures above were created on GeoGebra.