JUMP TO TOPIC

Tax|Definition & Meaning

Definition

Tax is money collected by the government in order to fund, build, and develop public infrastructure, social services, education, health care, and many other sectors that sustain and enhance a country’s growth. Tax is generally collected from the people of a country in the form of a deduction from income and sales, amongst various other things (taxable activities).

Demonstration of Tax with Real-life Example

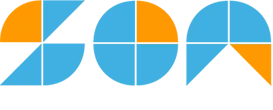

Figure 1 – Explanation of Tax with respect to real-life example

Taxes must be collected because governments need money to pay for their various operations, services, and programs. For the majority of governments, taxes are the main source of income. Without them, the government would not have the resources to maintain a stable economy and offer essential public services.

Healthcare Example

Consider a government that offers its citizens access to a healthcare system as an illustration. The government needs money to build and maintain hospitals and clinics, pay the wages of healthcare professionals, and buy medical equipment in order to maintain this system.

The government would be unable to provide these services in the absence of tax revenue, and people would be required to cover their own medical expenses, which could be challenging for those who cannot afford it.

Infrastructure

Another illustration would be the upkeep of public transportation, roads, and bridges. A functioning economy depends on these services, and the government needs money to maintain and enhance them. The government wouldn’t have the funds necessary to maintain these systems if taxes weren’t collected, which would lower citizens’ quality of life.

Purpose of Tax A Big Picture

Taxes are primarily collected for the following reasons:

- Finance government operations: Taxes are the primary source of income for governments, and they are used to pay for public goods and services like social security, healthcare, and infrastructure.

- Ensure fiscal stability: Taxes give governments a reliable source of income to cover their expenses, which helps them balance their budgets and ensure fiscal stability.

- Promote economic growth: Governments can encourage economic development and raise the standard of living for their citizens by using tax revenue to invest in infrastructure, education, and other vital factors that contribute to economic growth.

- Lessen income inequality: Progressive tax systems aim to lessen income inequality by taxing those with higher incomes more heavily. This makes sure that everyone pays their fair share of taxes and that those who can afford to do so contribute more to the government’s revenue.

- Promote socially beneficial behavior: By providing tax incentives or levying taxes on certain activities, such as buying unhealthy products or investing in renewable energy, governments can promote or discourage particular behaviors.

- Regulate commerce: By imposing tariffs or taxes on imported goods, which reduce their competitiveness with domestic products, taxes can also be used to regulate commerce and protect domestic industries.

Evidently, taxation is a big part of a country’s economy.

Formula for Tax

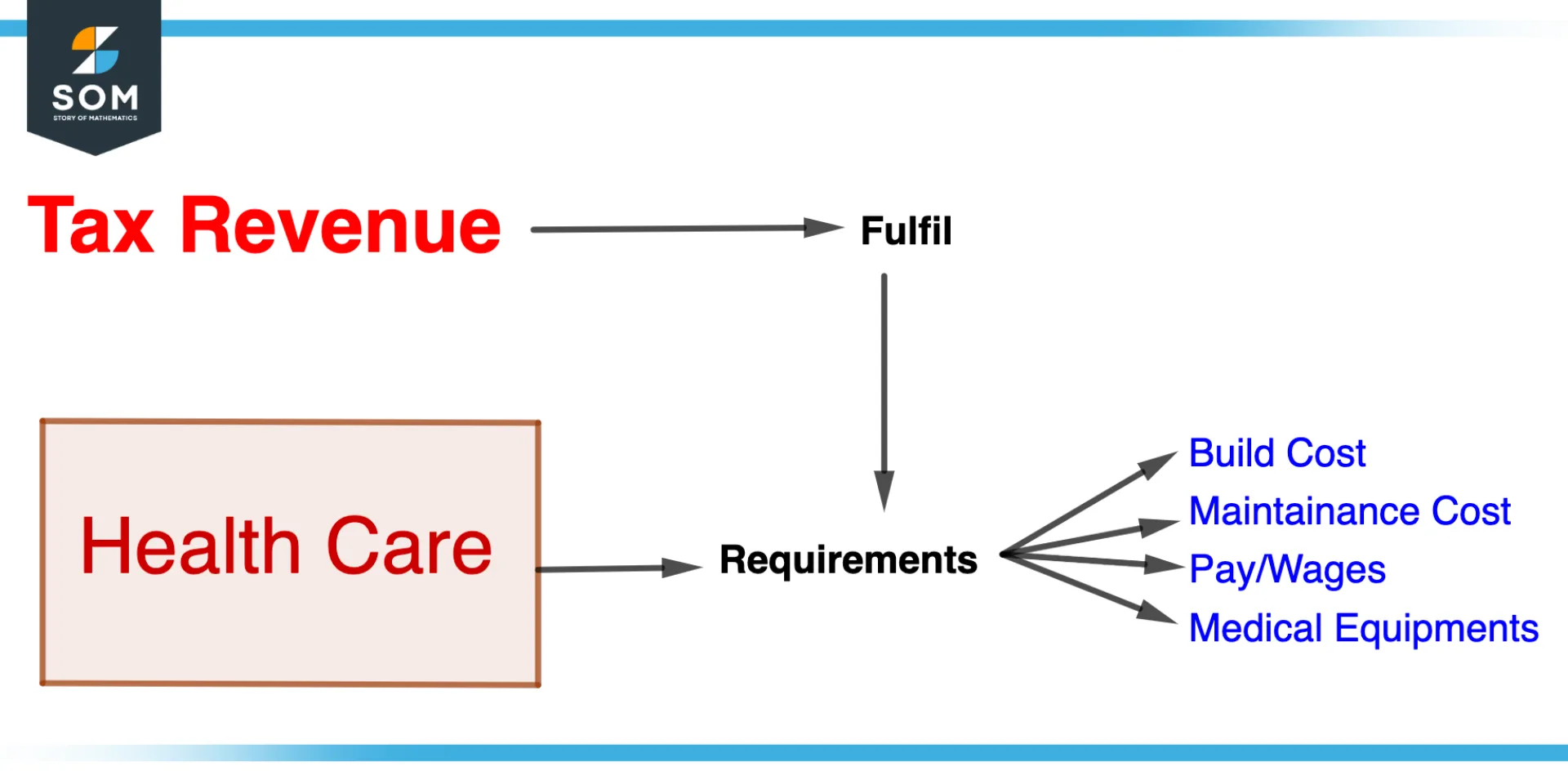

Figure 2 – Formula for Calculating Tax

Tax types and tax rates affect the formula used to calculate taxes. However, the following is a typical tax calculation formula:

Tax = Taxable income * Applicable tax rate

The terms “Taxable Income” and “Tax Rate” in this formula denotes the amount of income that is subject to taxation and the proportion of that income that is subject to taxation, respectively. The calculation would be as follows, for instance, if a person’s taxable income is $30,000 and their tax rate is 15%, then:

Tax = 30,000 x 15% = 4,500

Therefore, in this case, the taxpayer would owe 4,500 in taxes.

The tax rate can vary depending on the taxable income, with higher rates being applied to higher incomes, so it’s important to remember that taxes aren’t always calculated at a flat rate. Additionally, the formulas used to determine the amount owed for various taxes, such as sales tax, property tax, or excise tax, can vary.

Types of Tax

There are two main types of taxes: direct taxes and indirect taxes. They vary in terms of how they are imposed and who is responsible for paying the tax.

Direct Tax

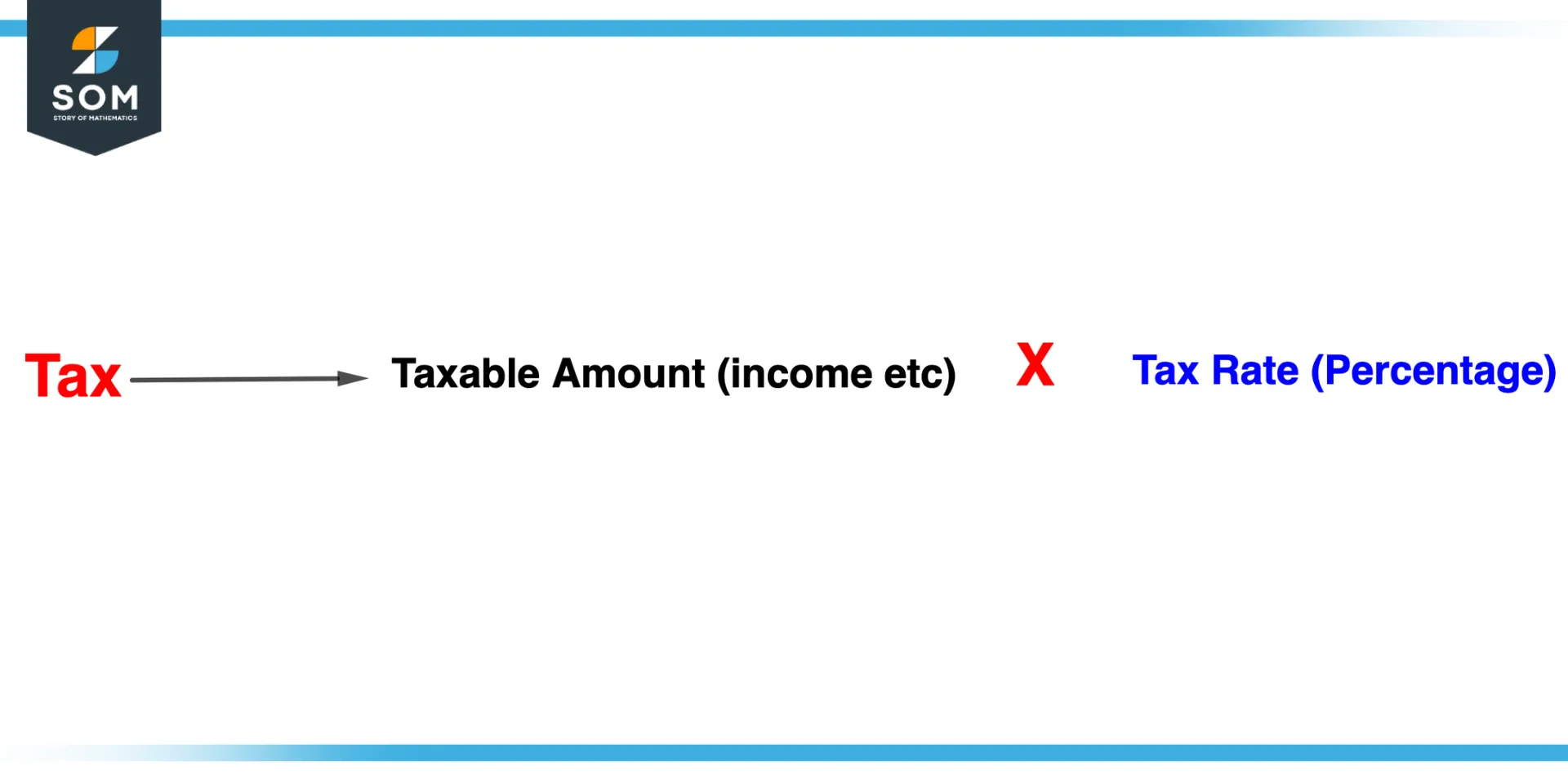

Figure 3 – Direct Tax Flowchart

A direct tax is one that is imposed on a person or a company directly. The tax liability is placed squarely on the shoulders of the taxpayer, who is also in charge of paying the tax to the government. Income tax, property tax, and gift tax are a few examples of direct taxes.

Income Tax

When it comes to income tax, the taxpayer must declare their taxable income and pay the tax to the government directly.

Property Tax

Real estate is subject to a tax known as property tax, which must be paid in full to the government by the taxpayer.

Gift Tax

The recipient of the gift must pay the tax to the government on their behalf. A gift tax is a tax on gifts received.

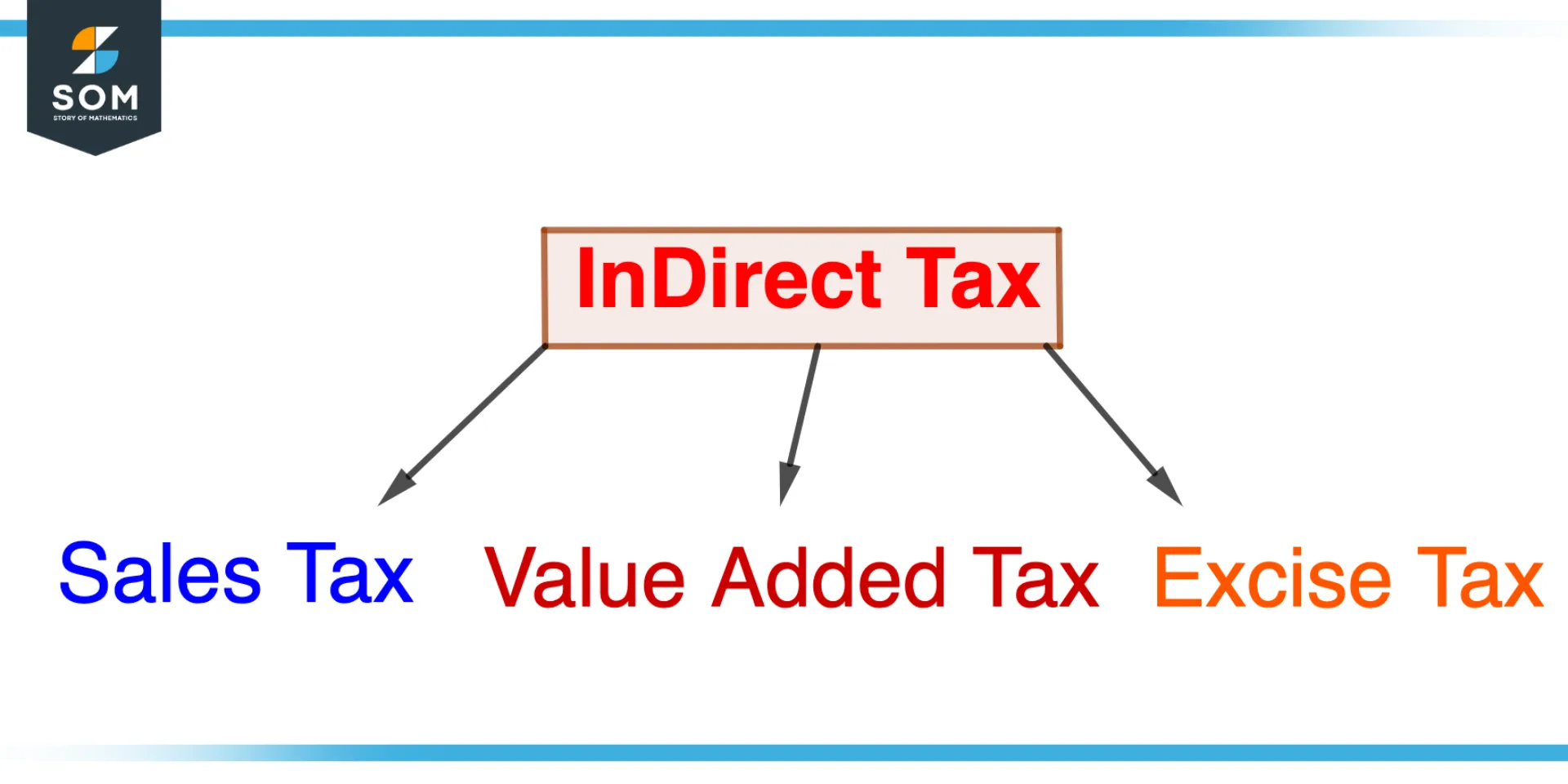

Indirect Tax

Figure 4 – Flowchart of Indirect tax

Taxes imposed on the production or sale of goods and services are known as indirect taxes. Although the producer or seller is responsible for paying the tax, the consumer ultimately bears the cost of the tax in the form of a higher price for the goods or services. Sales tax, value–added tax (VAT), and excise tax are a few examples of indirect taxes.

Sales Tax

In the case of sales tax, it is the seller’s duty to obtain payment from the customer and send it to the government.

Value Added Tax

The cost of the tax is passed on to the consumer in the form of a higher price for the goods or services through the value–added tax (VAT), which is a tax on the value added at each stage of production or distribution.

Excise Tax

Excise tax is a tax levied on particular products, such as alcohol and tobacco, and it is passed along to the consumer in the form of an increased price for the product.

Solved Example Involving Taxes

Example 1

A person is subject to a federal tax rate of 21% and has a taxable income of 70k. Determine the federal tax liability.

Solution

First, we know that tax is determined by multiplying taxable income by the applicable tax rate. When we enter the numbers, we get:

Tax = 70,000 x 21% = 14,700

The person’s federal tax debt is, therefore, 14,700.

Example 2

A homeowner is charged 1.15% in property taxes on a home with a 220,000 taxable value. Determine the amount of unpaid property taxes.

Solution

First, we apply the tax calculation formula:

Tax = Taxable Value * Tax Rate

When we enter the numbers, we get:

Tax = 220,000 x 1.15% = 2,530

Thus, the homeowner’s property tax liability is 2,530.

All mathematical drawings and images were created with GeoGebra.