JUMP TO TOPIC

Deposit|Definition & Meaning

Definition

A deposit is a cash outflow for one of three primary purposes: (1) to transfer money to a bank account (if it is your own, this is a credit), (2) an initial payment while buying from a seller as a show of good faith, and (3) as a security against violating some agreed-upon condition (i.e., the amount will not be returned if the condition is violated).

Depositing Process

The deposit process varies with the situation. Mostly we divide this process into two main categories. The first category means that the deposit that has been made by one party has been done as safekeeping. This transfer of funds means that the money is being stored or held in a bank account for a while.

This acts as insurance for one party, whereas the other party gets to keep the money that has been deposited. This money can be withdrawn, transferred, or used on any goods.

Such deposits are used in banks for opening new accounts in the form of transactional deposits or by someone who is renting or lending value and needs assurance of the security of that item. This type of money is considered liquid as it is available without any delay.

Figure 1 – Deposit in a bank

The other category of depositing funds is the type of funds that is kept by one party as a form of collateral for a good. Such funds are taken at the beginning of any deal and are later used up in case of any damage. So such type of money is not available at all times and cannot be used in any form.

Real-life Examples of Deposit

- Deposits are used in large purchases such as real estate, which are known as down payments.

- Vehicle companies also set a certain percentage for down payments.

- Banks use deposited money of people to use as an investment while giving interest to the contributor.

- For rental company deposits act as a security for any loss or damage, and the money is returned after verification of the goods.

Types of Deposits

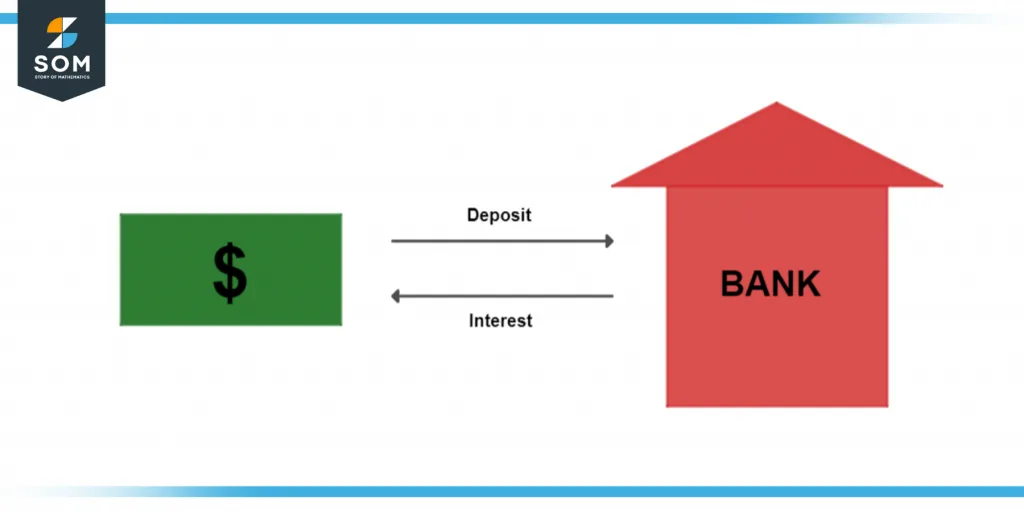

Figure 2 – Types of Deposit

There are 3 types of deposits:

Demand Deposit

A demand deposit is the type of deposit in which the item that has been deposited can be withdrawn at any moment with just only a short notice. There may be some issues regarding the withdrawal frequency depending upon the type of bank account one has otherwise, a demand deposit is liquid money that can be used or transferred anywhere.

Time Deposit

Such deposits, which are kept for some time, are known as time deposits. These are also known as the term deposits. Such deposits have fixed interest rates.

Special Deposit

When money is deposited into a bank, it sort of becomes a property of the bank, which is returned to the original owner. The returned money is not the original money that was given but is the same amount. But a special deposit is such an amount that is not used up by the bank and is returned to the depositor when needed.

Solved Examples

Example 1

Write the difference between demand deposits and term deposits.

Solution

Figure 3 – Difference between demand and time deposits

Demand Deposit

A demand deposit is a type of deposit where a contributor can withdraw every single amount of money or asset without facing any penalty. This type of deposit provides additional outstanding liquidity and straightforward entry or easy access when it comes to the transfer and usage of the funds.

Term Deposit

A term deposit is the other name of the time deposit. When a person contributes or deposits money, then he will have to wait for a specific time until that amount can be withdrawn. This type of deposit imposes some restrictions on its users. But the plus point of such deposits is the higher interest rate.

For one person to get his funds back, he must give a notification for the termination of the account. Then they can choose whether to keep the money or invest in another term deposit.

Example 2

Terry placed a deposit for one year at an annual rate of 4.5%. His amount rose to € 2,612.5 after 1 year. Find the initial deposit that Terry placed.

Solution

y = 100% + 4.5% = 1 + 4.5/100 = 1.045

y * x = 2612.5

1.045 * x = 2612.5

1.045x = 2612.5

x = 2612.5/1.045 = 2500

x = 2500

Example 3

How much € will Rosa have to save on a 3-month term deposit which offers an interest rate of 2.5% pa? If she wants the deposit to earn an interest of € 1,100

Solution

y1 = 2.5% = 1002.5 = 0.025

y2 = 3/12 * q1 = 3/12 * 1/40 = (3 * 1) / (40 * 12) = 3/480 = 1/160 = 0.0063

z = 1100 Eur

x * q2 = a

x * 0.00625 = 1100

0.00625x = 1100

x = 1100/0.00625 = 176000.00000256

Rounding off:

x = 176000.000003 = 176000 Eur

Example 4

What kinds of deposits are there?

Solution

There are 3 different kinds of deposits. Each type serves a different purpose;

Buying

When one buys any item, the amount which is given to give confidence that the rest of the payment will be paid is often referred to as the deposit. For example:

Mary deposited $200 to get the latest LCD for her room out of the total amount.

Renting

It is the money one has to deposit so that in case of any damage or loss, the owner doesn’t have to pay. It is known as a security fee which builds confidence between the owner and the customer. For example:

Andy lost $300 from his security fee because of the window that shattered

Banking

It is the amount of money that is given as an investment to the bank. This money is used by the bank, and the same amount is returned. There are different types of such deposits which vary because of the access that is granted. This money is doubled by the interest that the bank offers to the contributor. For example:

Sarah deposited $400 to the bank, and after a year, she got double the amount in return.

Images/mathematical drawings are created with GeoGebra.