JUMP TO TOPIC

Markup|Definition & Meaning

Definition

In business economics, markup refers to the amount added to a product or service’s cost price. It is commonly presented as a percentage over cost. The concept of markup is significant in business as a seller would be unable to cover overheads or make a profit.

Figure 1: The markup rate can be calculated by dividing profit by the cost price.

Significance of Markup

A markup is an amount by which you raise the price. It suggests that you paid a certain price for it, and depending on how much you bump it up, you will sell it for a larger price. From a layman’s perspective, profit or margin is commonly referred to by these terms.

The retailer’s profit from each unit of the goods is determined by the markup he is permitted to use. If the markup is higher, the buyer will pay more and the seller will make more money.

The markup is usually computed as a percentage. Markup is vital for any business to make any profit or simply survive. Consumers sometimes complain about higher percentage markup on some products or services. For example in movie theaters, there is a massive markup on popcorn, beverages, and other edibles.

Markup is the value to include in prices in order to increase profit. It is described in percentage form. Many businesses consider their prices by calculating the cost of providing their goods and services, then adding a percentage to that cost. The amount of money you earn on each sale depends on your markup

When you bring markup pricing into account, it can assist you in determining competitive prices for your products and services that will enable your company to turn a profit. If you increase the prices of your products and services sufficiently, you can help cover any production-related costs.

Markup indicates the difference between the selling price and the item’s cost to the business. In general, a business generates more money if the markup is higher. The retail price of a product less its cost is known as markup.

Application of Markup

The concept of markup is widely used in management accounting while calculating costing and pricing. There are various ways in which the concept of markup can be used.

Making a profit is every company’s primary purpose. Choosing a product’s selling price is one way to accomplish that goal using markup or cost-plus pricing. Businesses must markup their goods and services by a certain amount to break even and cover their manufacturing costs.

Markup pricing is the best pricing approach to use if you need to quickly and accurately establish prices for a variety of products. This method is practical in some situations due to its relative simplicity and scalability.

Safe Markup Percentage

Although there is no predetermined “optimal” markup rate, most businesses choose a markup of 50%. A 50% markup, also referred to as a keystone markup denotes a price that is 50% greater than the value of the product or service.

For example, if there is a markup of 50% on an item whose cost price is $20, then the percentage would be 50% of $20 which equals $10. Hence, the selling price of that item should be 20 + 10 = $30.

It is safe to charge a markup of 50% for your goods or services because this guarantees that you will make enough money to cover manufacturing costs as well as generate a profit. If the margins are too thin, you might barely break even after manufacturing expenses.

Food is often marked up around 60% in the restaurant business, but only around 15% in the retail grocery sector.

Difference Between Markup and Margin

Markup can often be confused with margin since both of them refer to the profit that is generated. Accounting and sales problems may result from confusing markup with profit margin. As an illustration, you can wind up either underpricing or overpricing your goods, which might reduce your profits.

It is crucial to comprehend the two concepts to determine whether you are properly pricing your products. There is one big difference between them. Markup is the value attained by dividing profit by cost price.

Markup = Profit/Cost price * 100

While margin can be defined as profit divided by the selling price.

Margin = Profit/Sell price * 100

These are two alternative ways to calculate your profit from a sale. The amount of money that separates your buying and selling prices is the same for both of them. And they both use a percentage to indicate that sum. Even though they both refer to the exact same amount of money, your markup is always more than your margin.

Examples Explaining the Concept of Markup

Example 1

Johnny bought 10 shirts for $200. He makes a profit of $13 on each shirt after selling them. Calculate the markup rate on a single shirt.

Solution

To solve this problem, let us write the data that is given to us as follows:

Price of 10 shirts = $200

Price of a single shirt = 200/10 = $20

Profit on each shirt = $13

Now as we know:

Markup rate = Profit/Cost Price x 100

So putting the values in the equation, we get:

Markup rate = 13/20 x 100 = 65%

Figure 2: The above figure shows the markup rate of 65% calculated on a $13 profit and $20 cost price.

Example 2

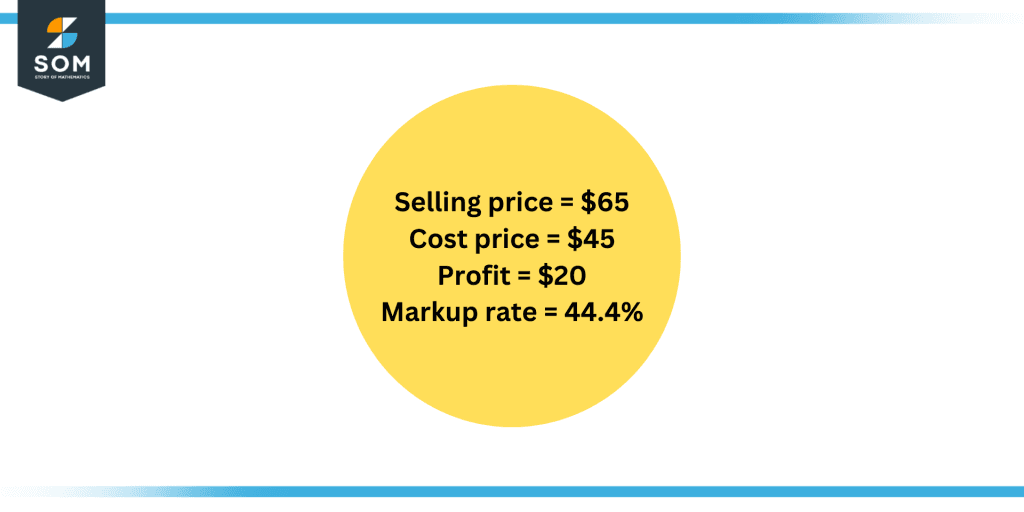

A bookstore pays its wholesaler $45 for some limited edition copies of a famous novel and sells them for $65. Determine the markup rate.

Solution

Let us write the data for the problem statement as follows:

Cost price = $45

Selling price = $65

Profit = 65 – 45 = $20

Now, as we know:

Markup rate = Profit/Cost Price x 100

So putting the values in the equation, we get:

Markup rate = 20/45 x 100 = 44.4%

Figure 3: Calculating markup rate with $65 selling price and $45 cost price.

Example 3

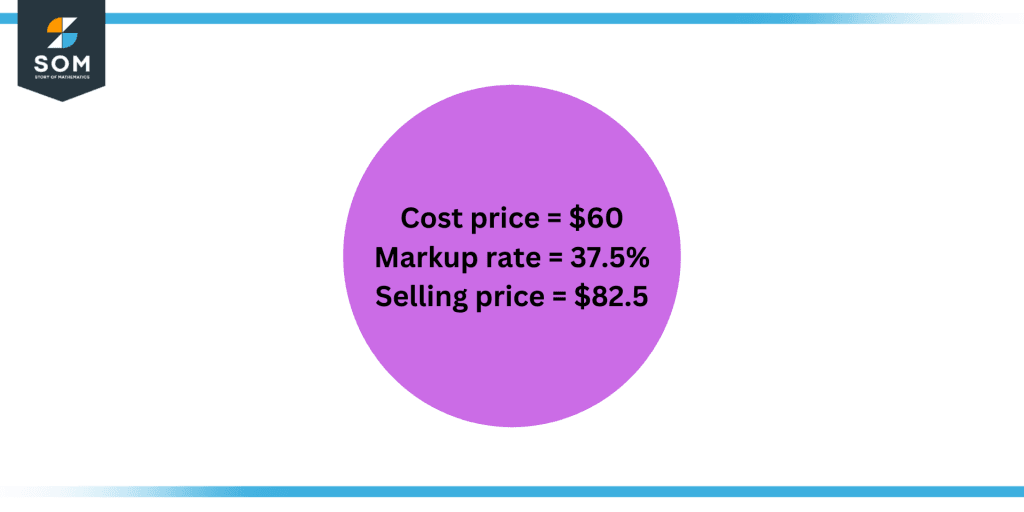

Felton purchases a game for his console for $60. After finishing the game, he resells it at a markup rate of 37.5%. Calculate the selling price.

Solution

Let us write the data for the problem statement as follows:

Cost price = $60

Markup rate = 37.5%

As we can see, we have to find the selling price as the markup rate and cost price are given.

For that purpose, we will perform the following calculation:

37.5% of $60 = $22.5

Selling price = 60 + 22.5 = $82.5

Figure 4: Calculating selling price when cost price and markup rate are given.