JUMP TO TOPIC

Debit|Definition & Meaning

Definition

A debit (in an account entry) represents a decrease in something’s worth. It is primarily a finance term. A very simple example is when you withdraw or spend money stored in a bank account. On the account statement, this transfer is considered a debit. It is the opposite of credit, which increases worth (e.g. if you transfer money into your account).

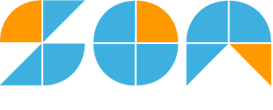

Figure 1 below shows an example of debit.

Figure 1 – Representation of debit

A debit is a balance sheet accounting item that results in a gain in assets or even a decrease in liabilities. In basic accounting, debits are countered by credits, which function inversely.

For example, if a company obtains a loan to buy equipment, it will debit capital assets plus credit a receivables account simultaneously, depending on the type of loan. Debit is commonly abbreviated as “dr,” which means “debtor.”

The Main Takeaways from Debit

- A debit is indeed an accounting item that reduces obligations while increasing assets.

- All debits were made just on the left of the ledger in double-entry accounting and needed to be offset with equal credit on the right portion of the ledger.

- Positive amounts for assets and expenditures are debited on a balance sheet, whereas negative payments are credited.

Difference Between Debit and Credit

Debits are an essential part of these dual accounting systems. Credits are the inverse of debits. Debits represent money taken out of a bank, whereas credits represent money deposited.

Because all credits are reported entirely on the row under the debits, all debts are put on the top lines, even the most basic diary entry.

When utilizing F l, a debit is on the left side of the chart, and even a credit is on the right. To assure the utilization of all general ledger and modified balance sheet items, debits, and credits.

The entire monetary value of all accounting systems should equal the total monetary value of all debit or credit transactions. To put it another way, money should always be balanced.

Figure 2 below shows the difference between debit and credit.

Figure 2 – Difference between debit and credit.

A hanging debit is a debit balance that does not have an offsetting credit card balance that allows it to be wiped off. It is used in financial accounting to indicate differences in a firm’s balance sheet and when a corporation buys goods or services to produce a negative.

For instance, if Barnes and Noble bought \$20,000 in books, it would deduct \$20,000 from its cash account and credit \$20,000 from its books and inventory account.

According to this double-entry technique, the corporation now has \$20,000 more than cash and \$20,000 less than books.

Standard Accounting Balances

In financial accounting systems, certain types of accounts possess natural balances. Natural debit balances exist for assets and expenses. Positive numbers for assets or expenses are debited, while negative balances are credited.

For example, if you receive \$1,000 in cash, a diary entry would reflect a \$1,000 debit to the chequing account on your balance sheet since money is growing.

If some other transaction involves a \$500 cash payment, the journal entry would include a \$500 credit to the chequing account since cash is being decreased. In effect, a debit rises, and a credit reduces an expenditure account on the income statement.

Figure 3 below shows the balancing of the accounts.

Figure 3 – Representation of balancing the accounts.

Natural Credit

Balances exist in liabilities, revenue, and equity accounts. The account balance is reduced when a debit is placed on any of these accounts. A debit to a accounts payable account on the balance sheet, for example, reflects the lowering of an obligation. Balancing credit is still most likely a debit to cash since reducing a liability entails paying off debt, and cash is an outflow. In the income statement’s revenue accounts, debit entries indicate a decline, whereas credits indicate a rise.

Debit Notes

Debit notes prove that one firm made a genuine statement of profit or loss when doing business with another (B2B). This might happen if a client returns products to a distributor and is asked to prove the amount refunded. The purchaser, in this situation, issues a debit note to show the accounting transaction.

A firm may issue a deposit slip in return for a credit note. Mistakes in a sell, buy, or loan statement (usually interest fees and penalties) may result in a business making a debit to assist in repairing the error.

A debit note, also known as a credit note, is quite close to an invoice.

Debit Margin

When buying on leverage, investors borrow cash from their broker and then combine these funds using their own to obtain more shares than they could use their funds. The brokerage debit amount reported in an investor’s account indicates the monetary cost of the trade to the investor.

In a margin requirement, the debit balance is the amount the client owes to the brokerage (or the other lender) for monies provided to acquire securities. The credit balance is the sum of money a customer must deposit into the margin account after successfully executing a security buy order to complete the transaction correctly.

The debit balance and credit balance can be compared. A term deposit with only short-term securities will display a credit balance, whereas a term deposit with only long-term investors will show a debit balance. The credit line is the total of the short sale proceeds and the statutory margin amount per Regulation.

A trader’s margin account may contain both short and long-margin holdings. The adjusted negative balance represents the amount due to the brokerage company in a margin account, lesser earnings on short sells, and amounts in a special unusual account (SMA).

Examples of Debits

Below is an example of debt

Example 1

John seemed to have a \$500 balance, which has now been reduced to \$200. Determine the debt.

Solution

To calculate debt, we have to subtract the reduced cost from the balanced cost.

\$500 – \$200

After subtraction, we get the answer as \$300.

So, the debt is \$300.

Example 2

A college student paid for his meal using his debit card. The current balance of his account was \$650. After paying for the meal, his account balance is \$630. Find the debt amount.

Solution

We subtract the total amount from the remaining balance to calculate the debit. As shown below:

\$650 – \$630 = \$20

This gives us a debit amount of \$20.

All Images are made using GeoGebra.